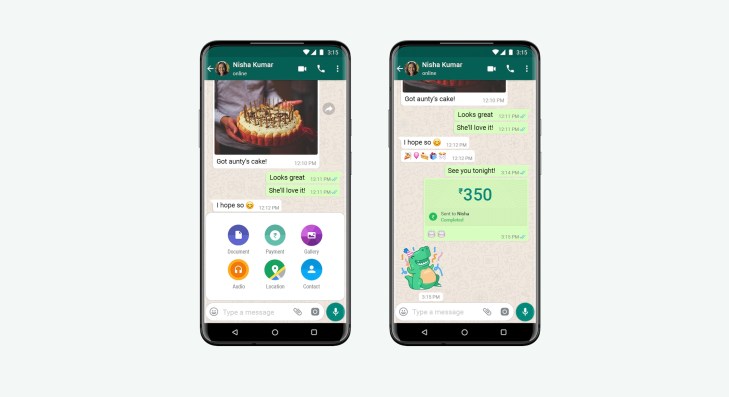

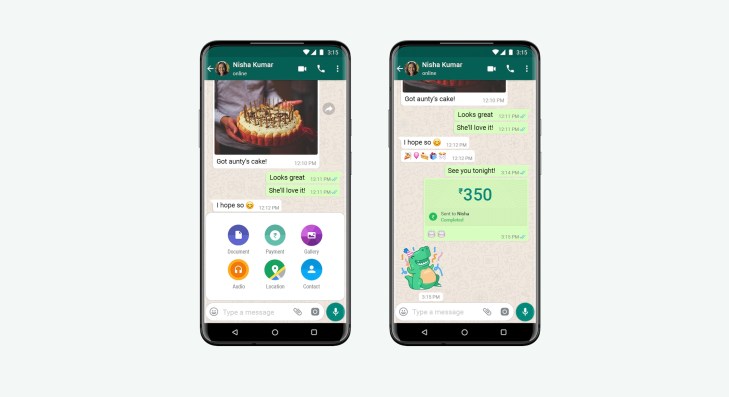

Facebook launched the WhatsApp payment service for users in India, after receiving approval from the country's regulators.

The service was first launched in India as a beta in 2018, but full rollout has been delayed for years due to concerns over privacy and data security. This is an important launch event for WhatsApp's largest marketplace, home to around 400 million users. Quoted from The Verge, Saturday, India's retail payments regulatory agency (NPCI) gave approval to WhatsApp, which was welcomed by Facebook CEO Mark Zuckerberg. "Now you will be able to easily send money to your friends and family via WhatsApp as easily as sending a message," said Zuckerberg.

He also said digital payments are "very important" during the global pandemic, as they eliminate the need for direct cash exchange. The WhatsApp payment system will use India's national payment infrastructure, known as the Unified Payments Interface or UPI.

This allows interoperability between various applications, which are also used by PhonePe Walmart and Google Pay, India's two largest UPI mobile payment providers, with both controlling about 40 percent of the market.

However, digital payment providers in India will face new challenges. As TechCrunch reports, NPCI also announced that it will limit the number of UPI transactions that each service can process to "(protect) the UPI ecosystem." Going forward, no service will be allowed to process more than 30 percent of the total UPI transaction volume, but it is unclear how this limit will be enforced.

WhatsApp will take a while to reach this limit, although the NPCI said it would curb Facebook's payment service from the start. The regulatory agency said WhatsApp would only be allowed to launch the service on a "tiered" basis, starting with a "maximum registered user base" of UPI's 20 million subscribers.

In a blog post, Facebook said it was working with five "leading banks" on its new payment service, namely with ICICI Bank, HDFC Bank, Axis Bank, State Bank of India and Jio Payments Bank. UPI itself is supported by more than 160 banks.

The service was first launched in India as a beta in 2018, but full rollout has been delayed for years due to concerns over privacy and data security. This is an important launch event for WhatsApp's largest marketplace, home to around 400 million users. Quoted from The Verge, Saturday, India's retail payments regulatory agency (NPCI) gave approval to WhatsApp, which was welcomed by Facebook CEO Mark Zuckerberg. "Now you will be able to easily send money to your friends and family via WhatsApp as easily as sending a message," said Zuckerberg.

He also said digital payments are "very important" during the global pandemic, as they eliminate the need for direct cash exchange. The WhatsApp payment system will use India's national payment infrastructure, known as the Unified Payments Interface or UPI.

This allows interoperability between various applications, which are also used by PhonePe Walmart and Google Pay, India's two largest UPI mobile payment providers, with both controlling about 40 percent of the market.

However, digital payment providers in India will face new challenges. As TechCrunch reports, NPCI also announced that it will limit the number of UPI transactions that each service can process to "(protect) the UPI ecosystem." Going forward, no service will be allowed to process more than 30 percent of the total UPI transaction volume, but it is unclear how this limit will be enforced.

WhatsApp will take a while to reach this limit, although the NPCI said it would curb Facebook's payment service from the start. The regulatory agency said WhatsApp would only be allowed to launch the service on a "tiered" basis, starting with a "maximum registered user base" of UPI's 20 million subscribers.

In a blog post, Facebook said it was working with five "leading banks" on its new payment service, namely with ICICI Bank, HDFC Bank, Axis Bank, State Bank of India and Jio Payments Bank. UPI itself is supported by more than 160 banks.

Last edited by a moderator: